How Do You Know When Ichimoku Cloud Has Buy Signal

Table of Contents

Ichimoku Cloud

Introduction

Fifty-fifty though the proper name implies one cloud, the Ichimoku Cloud is really a set of indicators designed every bit a standalone trading system. These indicators can be used to identify back up and resistance, make up one's mind trend direction and generate trading signals. Ichimoku Kinko Hyo, the Japanese name for the technique, is translated as "i look equilibrium chart." With one look, chartists tin identify the tendency and look for potential signals within that trend.

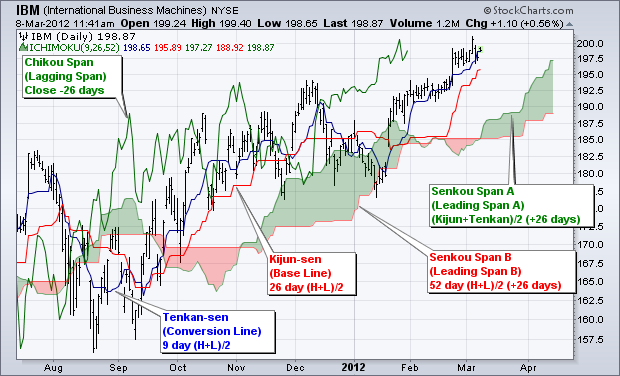

Defining the Indicators

There are v lines on the Ichimoku Cloud chart at any given time, and so allow's review the indicators before looking at strategy in depth. Come across our ChartSchool article for a detailed commodity on the Ichimoku Deject. The Japanese proper name is shown offset, followed past the English translation in parentheses. This commodity will apply the English translations.

Tenkan-sen (Conversion Line): (ix-catamenia high + 9-period depression)/2

On a daily nautical chart, this line is the midpoint of the 9-mean solar day high-depression range, which is almost ii weeks.

Kijun-sen (Base Line): (26-period high + 26-period low)/2

On a daily chart, this line is the midpoint of the 26-twenty-four hours high-low range, which is almost one month.

Senkou Span A (Leading Span A): (Conversion Line + Base Line)/2

This is the midpoint between the Conversion Line and the Base Line. The Leading Bridge A forms one of the two Cloud boundaries. It is referred to equally "Leading" because it is plotted 26 periods in the hereafter and forms the faster Deject boundary.

Senkou Bridge B (Leading Bridge B): (52-period high + 52-period low)/ii

On the daily chart, this line is the midpoint of the 52-twenty-four hour period high-low range, which is a little less than 3 months. The default calculation setting is 52 periods, only it tin be adapted. This value is plotted 26 periods in the future and forms the slower Deject boundary.

Strategy

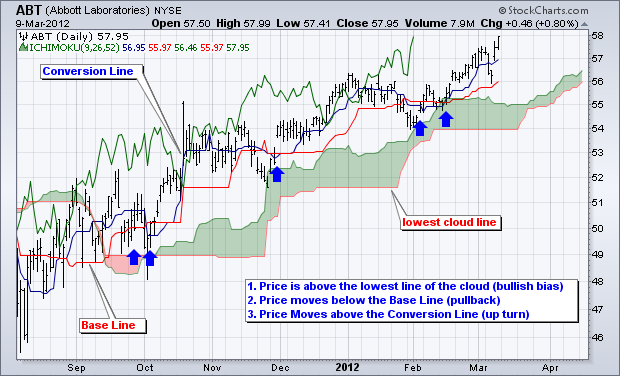

Chartists use the actual cloud to identify the overall trend and establish a trading bias. Once said bias is established, chartists volition wait for a correction when prices cantankerous the Base Line (cherry-red line). An bodily bespeak triggers when prices cross the Conversion Line (blue line) to indicate an end to the correction.

This trading strategy will set three criteria for a bullish signal. First, the trading bias is bullish when prices are in a higher place the lowest line of the cloud. In other words, prices are either above the deject or remain above cloud support. Second, price moves below the Base Line to bespeak a pullback and improve the risk-reward ratio for new long positions. Third, a bullish signal triggers when prices reverse and motility above the Conversion Line.

As yous tin can see, the three criteria will not be met in just one mean solar day. There is a pecking order to the process. First, the trend is bullish every bit defined by the cloud. 2d, the stock pulls back with a move below the Base Line. Tertiary, the stock turns back upward with a movement above the Conversion Line.

Purchase Signal Recap:

-

Cost is above the lowest line of the cloud (bullish bias)

-

Price moves below the Base of operations Line (pullback)

-

Price Moves above the Conversion Line (upturn)

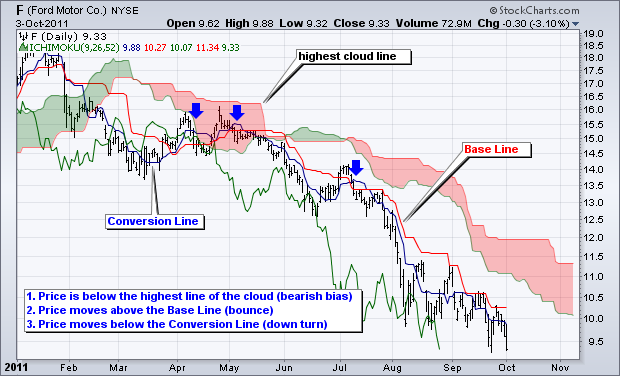

There are besides 3 criteria for a bearish indicate. Outset, the trading bias is bearish when prices are below the highest line of the cloud. This means cost is either below the deject or has notwithstanding to intermission above cloud resistance. Second, cost moves higher up the Base Line to signal a bounce within a bigger downtrend. Third, a surly betoken triggers when prices reverse and motion below the Conversion Line.

Sell Signal Recap:

-

Price is beneath the highest line of the deject (surly bias)

-

Price moves above the Base of operations Line (bounce)

-

Price moves beneath the Conversion Line (downturn)

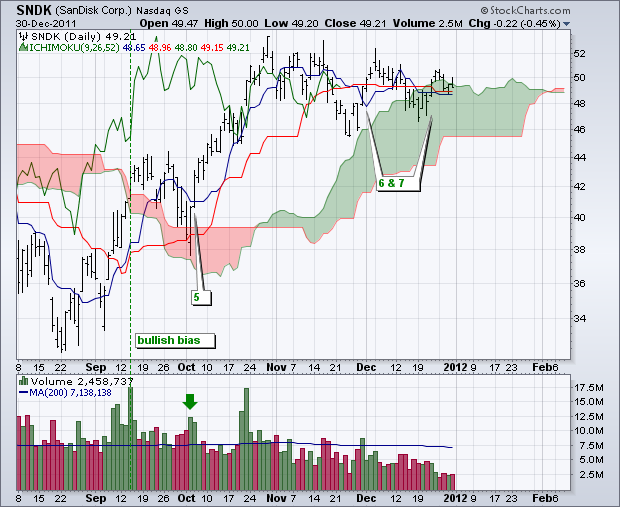

Trading Instance

The examples below show Sandisk (SNDK) with five unlike trading biases over a twelve-month period. Fifty-fifty though the stock declined from January 2011 until Baronial 2011, the trading bias shifted 3 times from Jan to June (blue box). Signals 1 and 2 resulted in whipsaws because the SNDK did not hold the deject. The trading bias can change often for volatile stocks because the cloud is based on lagging indicators.

A relatively potent trend is required to sustain a trading bias. Prices remain above the lower cloud line during a stiff uptrend and beneath the upper deject line during a potent downtrend. The trading bias shifted to bearish in early June and remained bearish equally a potent decline unfolded. There were 2 sell signals during this period: Signal 3 resulted in a whipsaw, only Signal 4 preceded a sharp decline.

Afterward a sharp reversal in August, the trading bias turned bullish with the upside breakout in September and remained bullish equally the accelerate extended. The first pullback produced a buy signal (v) with a dip below the Base Line (red) and a subsequent move above the Conversion Line (blue). At that place were two more buy signals during the consolidation period (6 & vii).

Adjusting

Chartists tin use volume to ostend signals, especially buy signals. A buy signal with expanding volume would acquit more weight than a buy signal on low volume. Expanding volume shows strong interest, which increases the chances of a sustainable accelerate.

Chartists also need to consider a strategy for stops, which can be based on indicators or key levels on the actual price nautical chart. The low only before a buy indicate would be logical for an initial end-loss subsequently a purchase bespeak. The high but earlier a sell point would be logical for an initial stop-loss afterward a sell signal.

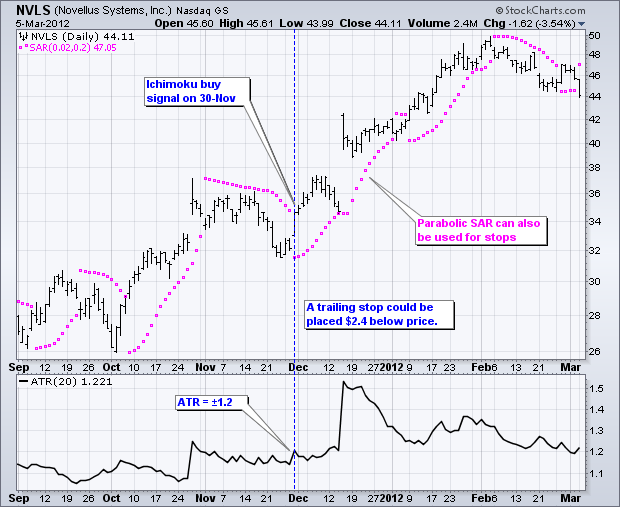

Once the trade is underway and prices motility in a favorable direction, chartists should consider a trailing stop to lock in profits. The case above shows Novellus (NVLS) with the Parabolic SAR for trailing stops. The indicator window shows the Average True Range (ATR), which can be used to fix a volatility-type finish. Some traders prepare stops two ATRs below electric current prices for long positions and two ATRs in a higher place current prices on curt positions.

Determination

This Ichimoku Cloud system provides chartists with a means of identifying a trading bias, spotting corrections and timing turning points. The cloud sets the overall tone and provides a longer perspective on the price trend. The Conversion Line (blue) is a relatively curt-term indicator designed to catch turns early. Catching the turn early on will better the risk-reward ratio for trades. Continue in mind that this article is designed as a starting point for trading system development. Utilize these ideas to augment your trading way, risk-reward preferences and personal judgments. Click here for a chart of IBM with the Ichimoku trading strategy.

Suggested Scans

Ichimoku Buy Signal

This scan searches for stocks on an Ichimoku Buy Signal.

[type = stock] and [country = us] and [daily sma(20,daily volume) > 100000] and [daily sma(threescore,daily shut) > xx] and [daily shut > daily ichimoku span b(9,26,52)] and [daily ichimoku span a(9,26,52) > daily ichimoku bridge b(ix,26,52)] and [daily close crosses daily ichimoku base line(9,26,52)]

Ichimoku Sell Signal

This scan searches for stocks on an Ichimoku Sell Point.

[type = stock] and [land = us] and [daily sma(20,daily volume) > 100000] and [daily sma(threescore,daily shut) > twenty] and [daily shut < daily ichimoku bridge a(9,26,52)] and [daily ichimoku span a(9,26,52) < daily ichimoku bridge b(9,26,52)] and [daily ichimoku base line(9,26,52) crosses daily close]

Further Study

Source: https://school.stockcharts.com/doku.php?id=trading_strategies%3Aichimoku_cloud

0 Response to "How Do You Know When Ichimoku Cloud Has Buy Signal"

Post a Comment